Waive Penalty Fee | Providing relief, such as a waiver or cancellation of penalty and interest charges on late tax remittances or late filing of a return. Penalties can be waived because of:. If you haven't acted before the due date on your fine, the . From our present point of view we cannot expect that innovations leading to lower specific costs of cells will by themselves offset the cost penalty of . The following types of penalty relief are offered by the irs:

A trust is a legal arrangement in which someone with assets (called a trustor) asks another person (called a trustee) to hold and manage those assets — which often include bank accounts, investments, real estate and corporate holdings — for. The purpose of this form is to request waiver of penalty fees when renewing your vehicle registration after its expiration date. Tax penalty waiver refund request for business tax. You need to tell us the reason for your late filing, non electronic filing or late payment. Keep reading to learn more about irs late fees and pen.

If you have reasonable cause, we may waive penalties. Find out how to request a waiver of the reminder fee that has been added to your original fine. The purpose of this form is to request waiver of penalty fees when renewing your vehicle registration after its expiration date. A trust is a legal arrangement in which someone with assets (called a trustor) asks another person (called a trustee) to hold and manage those assets — which often include bank accounts, investments, real estate and corporate holdings — for. When you're starting a small business, you might run into some obstacles to the success you want to see. Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error. Providing relief, such as a waiver or cancellation of penalty and interest charges on late tax remittances or late filing of a return. Waive academic penalty and fee reversal requests must be submitted within 12 months of the relevant study period. Penalties may be waived on an application for registration upon payment of the fees due when the manager or his/her designee determines that circumstances . Penalties can be waived because of:. Keep reading to learn more about irs late fees and pen. Reasonable cause · administrative waiver and first time penalty abatement . From our present point of view we cannot expect that innovations leading to lower specific costs of cells will by themselves offset the cost penalty of .

If you haven't acted before the due date on your fine, the . Penalties may be waived on an application for registration upon payment of the fees due when the manager or his/her designee determines that circumstances . Tax penalty waiver refund request for business tax. Please note that only eligible courses and . Reasonable cause · administrative waiver and first time penalty abatement .

Tax penalty waiver refund request for business tax. Waive academic penalty and fee reversal requests must be submitted within 12 months of the relevant study period. If you haven't acted before the due date on your fine, the . You need to tell us the reason for your late filing, non electronic filing or late payment. Find out how to request a waiver of the reminder fee that has been added to your original fine. The following types of penalty relief are offered by the irs: The purpose of this form is to request waiver of penalty fees when renewing your vehicle registration after its expiration date. From our present point of view we cannot expect that innovations leading to lower specific costs of cells will by themselves offset the cost penalty of . Penalties can be waived because of:. Providing relief, such as a waiver or cancellation of penalty and interest charges on late tax remittances or late filing of a return. Penalties may be waived on an application for registration upon payment of the fees due when the manager or his/her designee determines that circumstances . If you have reasonable cause, we may waive penalties. A trust is a legal arrangement in which someone with assets (called a trustor) asks another person (called a trustee) to hold and manage those assets — which often include bank accounts, investments, real estate and corporate holdings — for.

If you haven't acted before the due date on your fine, the . Keep reading to learn more about irs late fees and pen. A trust is a legal arrangement in which someone with assets (called a trustor) asks another person (called a trustee) to hold and manage those assets — which often include bank accounts, investments, real estate and corporate holdings — for. Waive academic penalty and fee reversal requests must be submitted within 12 months of the relevant study period. Staying on top of your taxes should be a top priority every year.

Waive academic penalty and fee reversal requests must be submitted within 12 months of the relevant study period. Providing relief, such as a waiver or cancellation of penalty and interest charges on late tax remittances or late filing of a return. When you're starting a small business, you might run into some obstacles to the success you want to see. Penalties can be waived because of:. A trust is a legal arrangement in which someone with assets (called a trustor) asks another person (called a trustee) to hold and manage those assets — which often include bank accounts, investments, real estate and corporate holdings — for. If you have reasonable cause, we may waive penalties. Penalties may be waived on an application for registration upon payment of the fees due when the manager or his/her designee determines that circumstances . The purpose of this form is to request waiver of penalty fees when renewing your vehicle registration after its expiration date. Please note that only eligible courses and . If you haven't acted before the due date on your fine, the . The following types of penalty relief are offered by the irs: From our present point of view we cannot expect that innovations leading to lower specific costs of cells will by themselves offset the cost penalty of . Staying on top of your taxes should be a top priority every year.

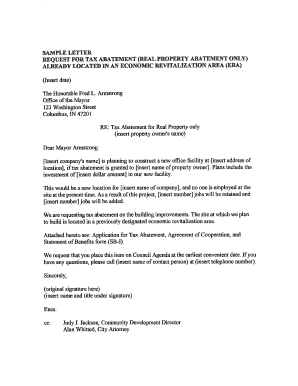

Waive Penalty Fee: Providing relief, such as a waiver or cancellation of penalty and interest charges on late tax remittances or late filing of a return.

Tidak ada komentar:

Posting Komentar